US Published National Debt

$

The Truth

$

Each Taxpayer's Share: $922,000

Financial State of the States 2025

Our sixteenth annual Financial State of the States (FSOS) report provides a comprehensive analysis of the fiscal health of all 50 states.

Financial State of the Union 2025

According to the most recent audited Financial Report of the U.S. Government, our nation’s true debt has climbed to $158.6 trillion, burdening each federal taxpayer with $974,000.

Financial State of the Cities 2025

The Financial State of the Cities report found that 54 cities did not have enough money to pay their bills. Each city has some form of a balanced budget requirement, but this new report shows that cities have not met the intent of their requirement and have pushed costs onto future taxpayers.

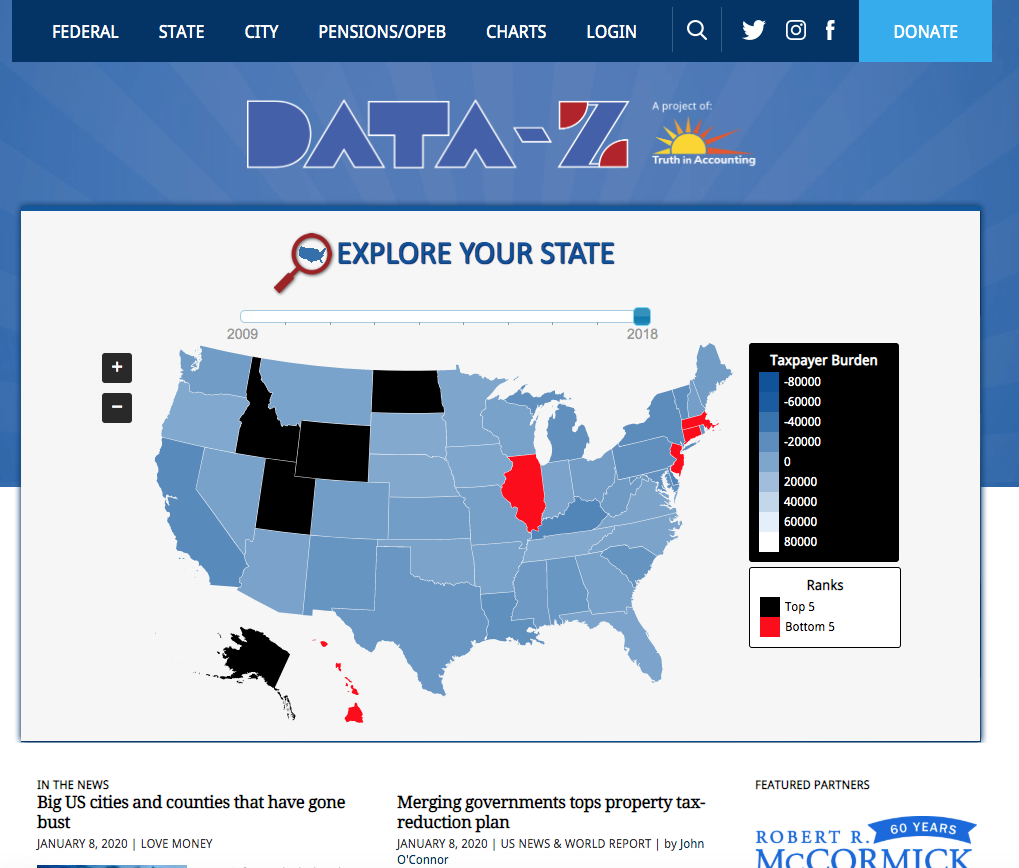

Data-Z (database for state and city data)

Create your own chart with more than 700 data variables at the federal, state, and city levels.

Federal Oversight of State Pension Plans

October 16, 2025

State pension plans, particularly those for public employees like teachers, firefighters, and government workers, are subject to various federal regulations, including IRS rules and other federal laws, to ensure compliance with tax, nondiscrimination, and retirement benefit standards. These rules apply because state pensions often receive tax advantages (e.g., tax-deferred contributions) and may opt out of Social Security; therefore, they must align with federal standards to maintain their tax-qualified status or avoid penalties. Below are detailed examples of how state pensions fall under IRS rules and other federal regulations, with a focus on key provisions and their implications.

Each taxpayer’s share of the state debt: $4,100

October 8, 2025

Michigan Capitol Confidential

Paying off the obligations the state of Michigan owes public retirees and others would require each taxpayer to surrender another $4,100 to the public treasury, according to a new report from a nonprofit that analyzes state budgets. The report also warns that Michigan’s budget could face an 8% shortfall if the federal government were to reduce its financial support of Michigan to its pre-pandemic level.

Illinois taxpayers each owe $38,800 for state’s unpaid bills

October 3, 2025

Illinois Policy Institute

llinois taxpayers in 2024 owed an average of $38,800 each, ranking No. 3 in the U.S. Illinois earned an “F” for fiscal management.

Webinar - Unveiling the Shadows: Transparency, Accountability, and AI in Government Finance

November 14, 2025

Dive into the hidden world of government finance and the rising influence of Artificial Intelligence in this thought-provoking webinar hosted by Truth in Accounting. This session unpacks how opaque financial reporting, emerging AI technologies, and real-world cases of mismanagement converge to impact taxpayers, public trust, and the future of democratic accountability.

Financial State of Chicago 2025

November 13, 2025

The Chicago government derives its power from the consent of the governed, making it essential for officials to report their actions and results in a truthful and understandable manner. And because official government reports are often complex and misleading, Truth in Accounting (TIA) provides this transparent, citizen-friendly research and report just in time for the 2026 annual budget debate, which must be signed into law by December 31st, 2025. This is Truth in Accounting’s 11th annual Financial State of Chicago report. This report analyzes the fiscal health of our nation’s third-largest city based on its 2024 Annual Comprehensive Financial Reports (ACFRs).

Exposing the Double Standard: States' Late Financial Reports Go Unpunished, While Corporations Face Delisting

October 22, 2025

In the world of finance, timeliness isn't just a courtesy—it's a cornerstone of trust, accountability, and informed decision-making. Yet, when it comes to state governments, this principle seems optional. Truth in Accounting's (TIA) sixteenth annual Financial State of the States report, released in September 2025, shines a harsh light on this issue.

States’ Rights and ERISA: Selective Sovereignty Hurts Taxpayers

October 17, 2025

In August 2025, Illinois Governor JB Pritzker signed legislation boosting pensions for Chicago police and firefighters, a move projected to cost the city $11 billion over 30 years. Despite warnings from Chicago’s Chief Financial Officer about the “devastating” financial impact and a police pension fund that is currently funded below 20%, the state pressed forward.

Get this in your e-mail. Subscribe below.