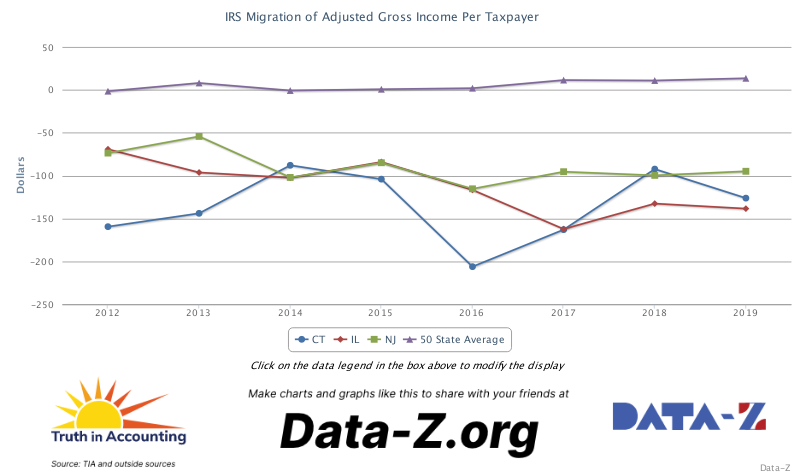

A few weeks ago, the IRS released an annual report useful for tracking interstate migration trends. The latest data echoed patterns we've seen in recent years. States with higher tax rates and worse state government financial condition continued to experience higher migration of taxable income.

More specifically, states where taxpayers pay relatively high taxes compared to personal income have been undergoing relatively high outmigration of taxable income -- the Adjusted Gross Income (AGI) reported on their annual tax returns. And taxpayers in states with state governments in worse financial condition, as measured by TIA’s “Taxpayer Burden,” have also had higher outmigration. The taxpayers in these states apparently can see some writing on the wall.

That’s the message from the latest IRS data. Unfortunately, the latest IRS data is only for 2019 – roughly two years ago and a year before the pandemic and lockdowns even started.

But a closer look at more recent data suggests the disturbing trend facing states like New Jersey, Illinois, and Connecticut – states with high taxes and/or poor government finances – have not enjoyed any real cause for celebration since the economic recovery started early this year.

You can view states and their results on AGI Migration with the charting facility at our Data-Z website.

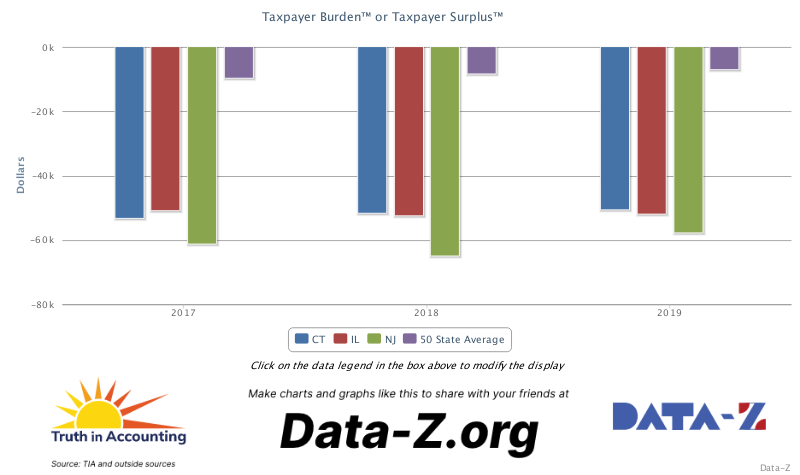

Here’s a look at New Jersey, Illinois, and Connecticut on TIA’s “Taxpayer Burden” measure of state government financial condition in the latest years for which we have audited financial reports, comparing them to the 50 state average. New Jersey, Illinois and Connecticut ranked as the lowest three states in the nation on this measure.

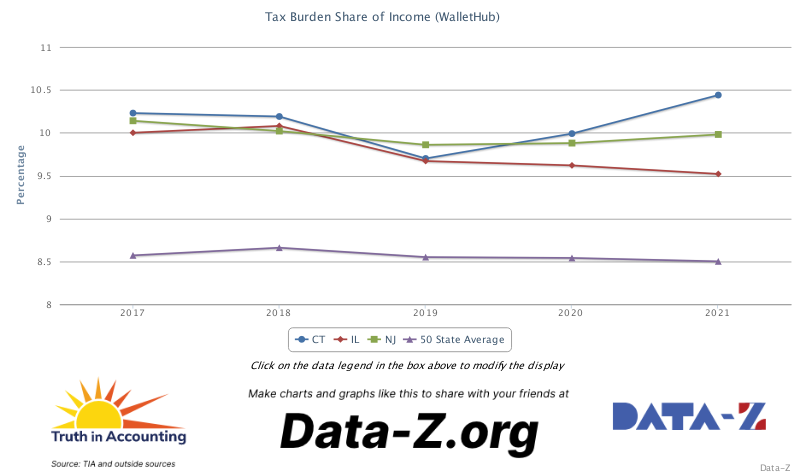

These three states also rank high on how heavy taxes are, relative to income, for taxpayers in those states. Here’s a similar chart comparing New Jersey, Illinois and Connecticut to the 50 state average based on WalletHub’s measure of tax burden, which relies on tax payments (not debt) for its measure of burden. (The years for WalletHub’s study relate to the year they published the data, not the year for income or taxes).

You can pay me now, or you can pay me later, the old commercial saying goes. Well, taxpayers in New Jersey, Illinois, and Connecticut were looking for the exits, at least through the latest year available for IRS migration data.

But what’s been happening lately, on the income migration front? After 2019 ended?

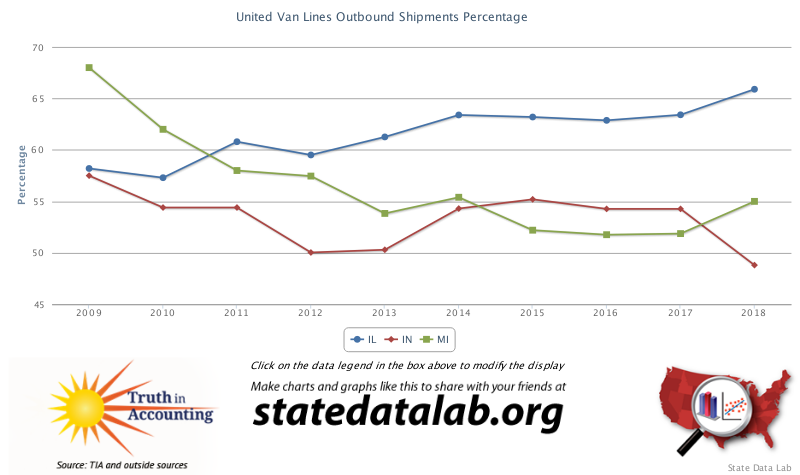

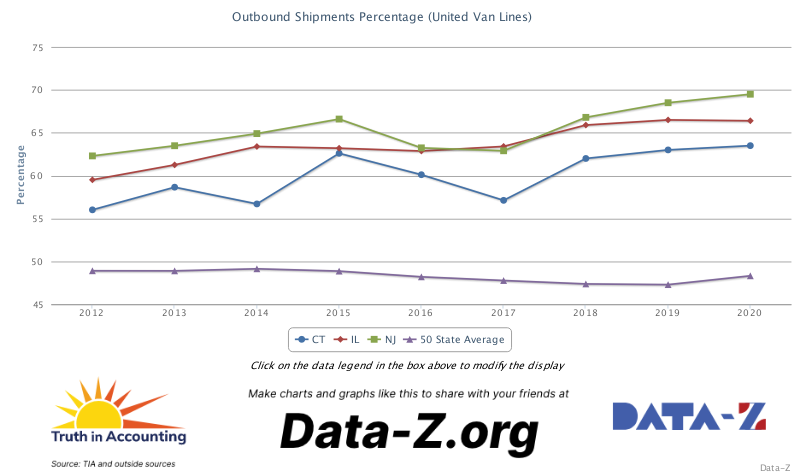

We don’t have IRS data for 2020, yet. But we do have migration estimates from United Van Lines, a large interstate moving company. The adverse migration trends for these three states remained in place, according to this source. If anything, the deterioration accelerated.

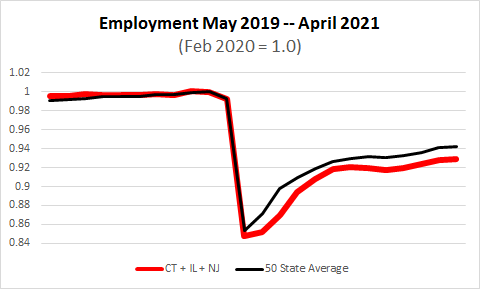

We can also look to monthly state-level estimates for employment produced by the Bureau of Labor Statistics for clues about recent trends relating to migration. Granted, job gains aren’t necessarily migration results, especially from recent estimates subject to annual revisions. But here too, the news isn’t good, at least for the likes of New Jersey, Illinois and Connecticut.

Employment has rebounded in recent months in those three states, as it has around the nation. But those three states took a significantly bigger hit in the early months of the crisis, in terms of total employment, and their recovery has actually lagged the national average since early 2020.