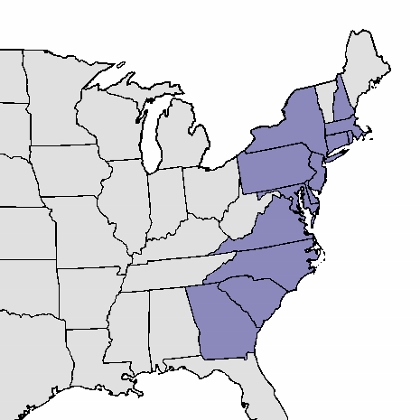

Our featured chart at State Data Lab this week looks at financial conditions in the original 13 states. From 2012 to 2013, debt per taxpayer declined in six of the original 13 states, according to TIA research. It increased in six states, and one had no change.

We’ve done a fair amount of work looking at factors associated with, and likely causing, some states to have higher debt per taxpayer than others. One interesting way to slice the data is to simply look at how old the states are. We include “Year Admitted to Union” in our 50-state State Data Lab database, and as a general tendency, the older the state, the higher the current per-taxpayer debt.

The original 13 states are not exceptions to this rule.

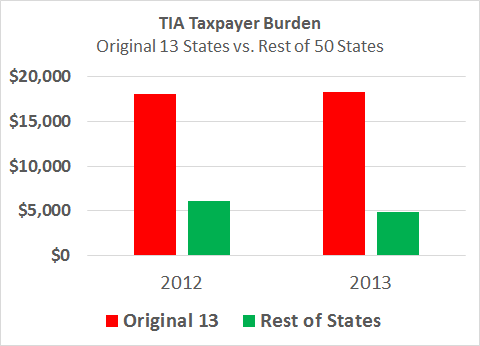

TIA’s “Taxpayer Burden” calculation for the 13 original United States averaged $18,300 in 2013, roughly four times as high as the average for the other 37 states. The average TIA Taxpayer Burden for the first 13 states increased a bit from 2012 to 2013, compared with a 20% decline in the other 37 states.

A longer story here, including relevant ideas from a fellow named Mancur Olson. We have discussed him a bit in our federal project, and here is a book he wrote with perspective on the matter. That book, titled The Rise and Decline of Nations, developed an argument that states tend to accumulate special interest group forces the longer they are around and relatively stable. Over time, however, forces like these undermine the general infrastructure they feast upon, and rising debt loads can be a symptom of this process.

How about another older 'state' -- the United States of America?

Not to change the topic a little, or anything, as long as we are looking at the original 13 states, let’s take a peek at the transition between the Articles of Confederation (1778) and the U.S. Constitution (1787) -- and in particular, the way those foundational documents treated financial reporting requirements for the emerging federal government.

Relevant text in the Articles of Confederation reads:

“The United States, in Congress assembled, shall have authority … to ascertain the necessary sums of money to be raised for the service of the United States, and to appropriate and apply the same for defraying the public expenses; to borrow money or emit bills on the credit of the United States, transmitting every half year to the respective States an account of the sums of money so borrowed or emitted …”

The new Constitution included the now-controlling Statement and Account Clause, which reads:

“No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

Hmm. On the face of the language, how did the requirement for federal financial reporting change? How well do our federal government’s current financial reports square up with the Statement and Account Clause?