In about an hour, the Treasury Department of the United States will release the annual Financial Report of the US government. We are looking forward to reading it, and will be focusing on a few key issues.

One thing to watch is – what is happening to interest expense incurred by the federal government, in the interest it pays on Treasury securities?

In 2014, interest expense was reported at $260 billion. This amounts to almost $1000 for every man, woman, and child in the United States – even before the government spends a dime on anything else.

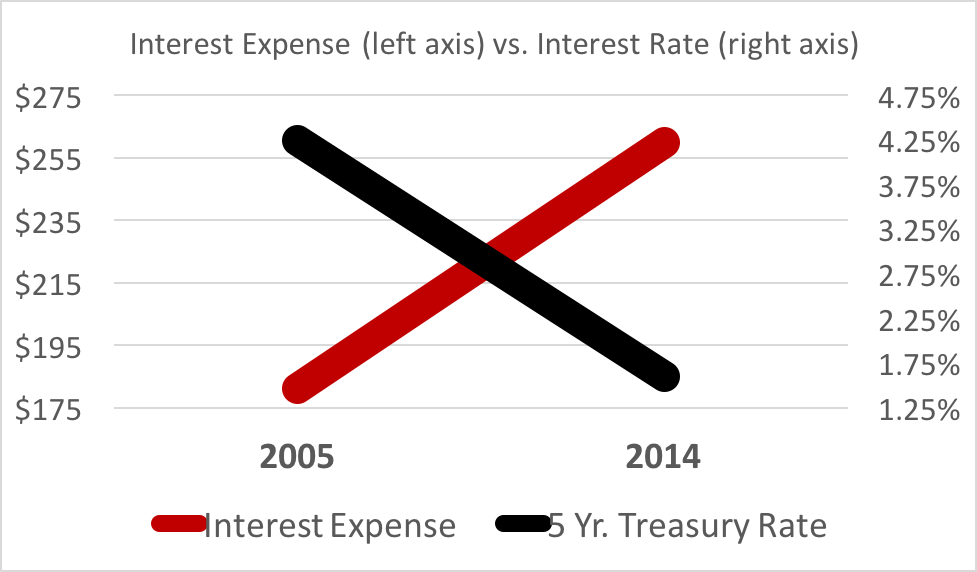

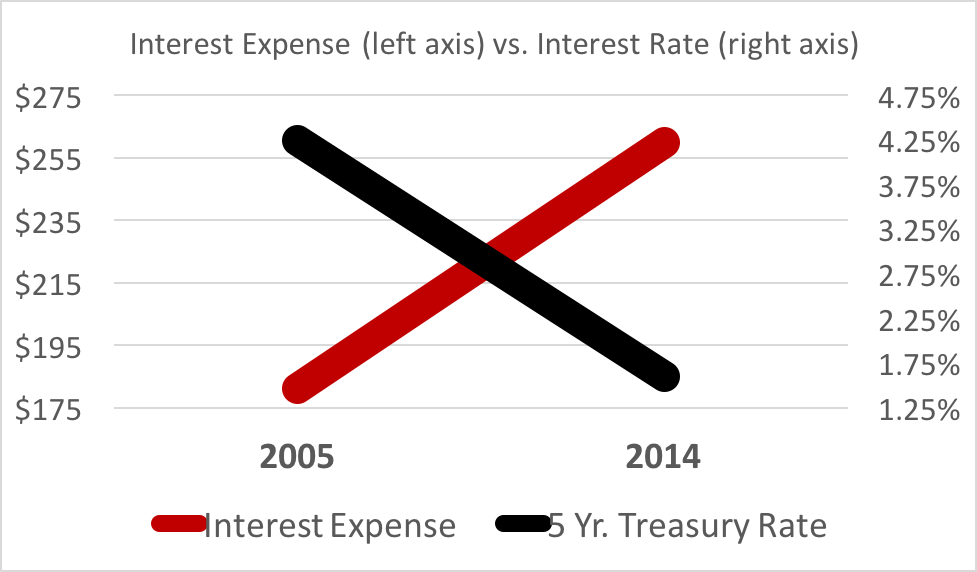

As high as this amount is, what is truly frightening is what has happened to interest expense over the last decade – a decade when interest rates fell to historic lows. From 2005 to 2014, interest expense rose over 40%, during a period when interest rates paid on 5-year Treasury bonds fell from about 4.25% to only 1.6%.

Squinting ahead, under current law and policy and looming demographic changes, the federal deficit and debt are set to rise significantly. What is the prospect for the interest burden on taxpayers if interest rates rise in the years ahead?

It doesn’t look like a pretty picture.