Our federal government runs a wide variety of insurance and insurance-like programs, including deposit insurance, crop insurance, flood insurance, terrorism risk insurance, and political risk insurance. Like insurance companies in the private sector, these entities charge premiums, invest the money, and pay out on claims for insured losses.

The federal Pension Benefit Guaranty Corporation (PBGC) provides another form of insurance – for pension plans in the private sector. It charges premiums that are set by Congress, and pays out for plans that become insolvent. PBGC stands behind the pensions for millions of people in the United States.

Can the PBGC itself become insolvent? Is it insolvent already? Do the PBGC’s finances put taxpayers generally at risk?

First, we have to define our terms. What does “insolvent” mean?

Dictionary.com defines insolvency as “… unable to satisfy creditors or discharge liabilities, either because liabilities exceed assets or because of inability to pay debts as they mature.”

Unfortunately, this doesn’t get us very far, given the ambiguity in the definition. Some entities can pay pay their bills currently, even if their liabilities exceed their assets. In this example, these entities may still be called “insolvent,” because their negative net position implies an inability to pay future maturing debts.

Banks and insurance companies are required by regulation to maintain minimum positive capital. If they don’t, they can be taken over by regulators, and liquidated or otherwise disposed of.

How about the PBGC?

In 2014, the PBGC reported total liabilities of $152 billion. This number has been growing rapidly in recent years, due to rising stress in PBGC-insured plans despite the recovery in the economy and financial markets.

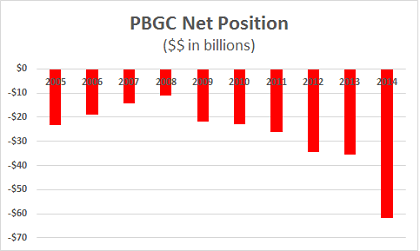

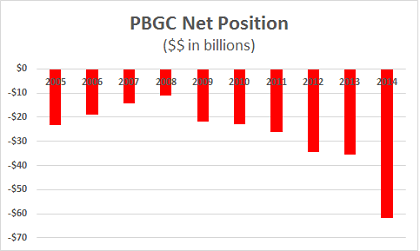

PBGC’s total liabilities have exceeded its total assets in each of the last ten years – and the shortfall has widened considerably in recent years. Here’s a look at what the government reports for PBGC's net position – assets less liabilities – in the last decade.

In the private sector, regulators would (or should) be all over an insurance company in this position.

In its 2014 financial report, discussing PBGC’s large multiemployer program, acting director Alice Maroni warned that “when the program becomes insolvent, PBGC will be unable to provide financial assistance to pay guaranteed benefits for insolvent plans.”

This must imply that PBGC is not currently insolvent, and that it defines insolvency in terms of ability to pay current debts, not as a matter of liabilities exceeding assets.

PBGC is a corporation, but a government corporation that is wholly-owned by the federal government. The federal government includes PBGC finances in its financial statements, which might suggest that taxpayers are at risk for the shortfall. Under current federal law, however, PBGC can only pay out from PBGC assets, not the general funds of the U.S. Treasury.

When push comes to shove, though, experience cautions us that taxpayers will be forced to pony up.

In the opening pages of PBGC’s annual report, U.S. Secretary of Labor Thomas Perez offered a “Message from the Chair.” Perez stated that “The defined benefit pension system and the PBGC guarantee make a real difference in the lives of workers and retirees.” This may be true, but for different groups of workers and retirees. There are many workers and retirees who are not being protected by PBGC, who pay taxes, and may in fact be threatened, not protected, by the PBGC.