The federal government’s personnel department is the Office of Personnel Management (OPM). OPM sets federal hiring procedures, manages job opening advertisement, conducts background investigations, administers security clearances, provides training and development programs for other agencies, and administers pension, health, and other retirement benefits for federal employees.

In 2015, there were 2.8 million people employed by the Federal government, basically unchanged from 2005. What has happened to the expenses reported for OPM over that time frame?

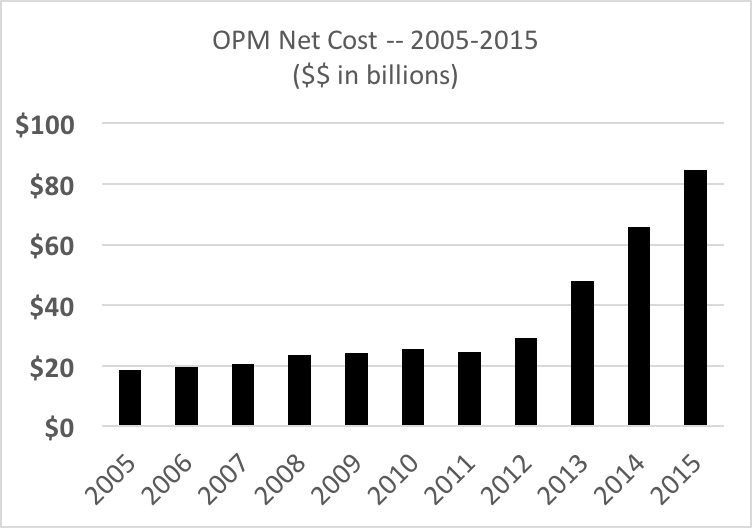

The chart below shows the “net cost” reported in the Financial Report of the US Government for OPM since 2005. (The net cost represents overall cost less revenue earned on fees for services.)

In 2015, the cost of the federal government’s personnel department apparently totaled over $80 billion – more than 4 times as much it cost in 2005, even as overall federal government employment in 2015 was about the same as it was in 2005. And the growth rate in the cost of the department has accelerated significantly in the last five years.

What’s going on here?

In the last week, we have been publishing a series of articles by Tom McKinney, former U.S. Army Auditor, on the federal government’s retirement benefit programs. McKinney has outlined how other agencies in the federal government have offloaded their own costs for retirement benefits into OPM, making themselves look less costly, at least on the surface.

There is another wild (if not disturbing) thing to look at in OPM’s costs reported in the federal government’s Statement of Net Cost. That statement takes gross cost and subtracts earned revenue to get to net cost, but it doesn’t stop there. In recent years, a new column has arrived called "(Gain)/Loss from Changes in Assumptions," and the table is structured Gross Costs less Earned Revenue equaling a “Subtotal,” followed by the “(Gain)/Loss from Changes in Assumptions” to arrive at “Net Cost.”

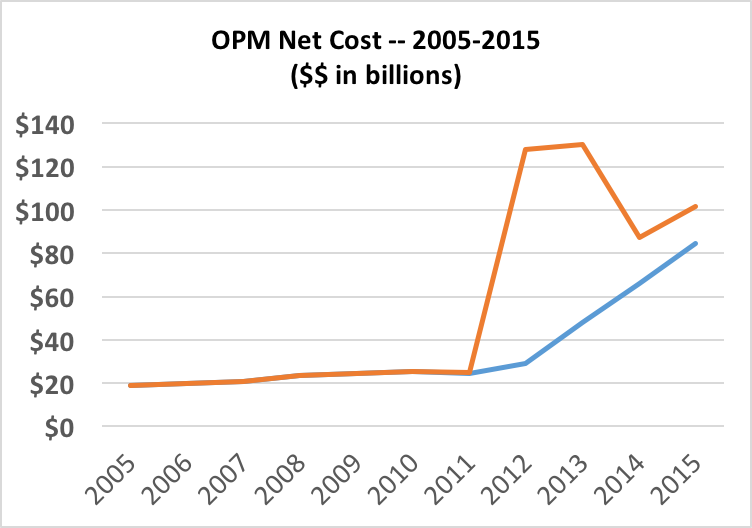

In recent years, OPM has reported massive changes in assumptions, and significantly higher “Net Cost” than on the basis it reported in the earlier years in the chart above. In 2012, for example, Gross Cost less Earned Revenue came in at about $30 billion, but OPM added another $100 billion in 2012 alone after changing its assumptions. (That may deal with assumptions like mortality, investment rate of return, and other factors embedded in actuarial valuations for pension plans, but I’m going to take a look at that.)

Here’s a look at the Before and After the impact of those changes in assumptions.

Something smells.